Insolvency by the Numbers: NZ Insolvency Statistics July 2023

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

Company insolvency appointments for July 2023 combined across all insolvency types have come in just under 2019 levels. Court liquidations remain a driver for these increased levels. This increase is following continued strong winding up applications driven by the IRD and its recovery efforts.

As a percentage share of appointments, the figures have remained consistent from last month.

Total corporate insolvency figures for the year to date continued to sit just behind 2019 figures. The slower start to the years insolvency appointments has yet to be recovered from.

While court liquidations have dropped slightly as an overall percentage they still remain above their long team average so remain a large portion of the below pie, we continue to see a drop in solvent appointments however.

Winding Up Applications

The increases seen over the last 3 months have finally pulled back slightly. While it is a drop on the last two months it may be the result of increased figures evening out compared to the usual spike we see in July. So a longer sustained lift rather than a July spike and drop off.

From the below graph we continue to see that IRD’s winding up applications close in on 3x the remainder of all creditors and has continued to grow as an overall percentage month on month since March.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

Personal insolvency appointments remain low and continue looking very similar to 2022 figures. As a breakdown of appointment types bankruptcies remain above their long term average with both No Asset Procedures and Debt Repayment Orders below their averages by 10 pts each.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..

Insolvency by the Numbers: NZ Insolvency Statistics June 2023

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

Company insolvency appointments for June 2023 combined across all insolvency types have beaten out all past years shown in the above graph back to 2019. Court liquidations have been a driver for these increased levels showing the highest figures since prior to 2020 with 59 appointments. This increase is following a number of months or stronger than usual winding up applications lead in part by IRD and its recent drive to collect delinquent debtors.

Whether this level of court appointments will continue into the election only time will tell what IRD does, or if shareholder appointments will continue to grow due to an ongoing cost of living crisis and general price increases. It appears unlikely that we will see a miraculous recovery before the end of 2023.

Total corporate insolvency figures for the year to date remain above the last 3 years and have begun to once again pull back 2019 figures with a strong June. For the year to date 2023 is one 21 appointment behind 2019, realistically this is only 2 – 3 days of appointments. 2023 remains a far cry from 2018 which was at 1,111 total appointments for the year to date.

Winding Up Applications

In June, there has been a consistent increase in the number of winding up applications compared to past Junes. In June 2021, there were 83 applications, with 21 being company winding up applications and 62 being IRD winding up applications. The trend continued in June 2022, with 38 total applications, including 15 company winding up applications and 23 IRD winding up applications. June 2023 saw a further rise, reaching 95 applications, consisting of 33 company winding up applications and 62 IRD winding up applications.

When considering the year-to-date figures, we observe a continuous increase in the cumulative total of winding up applications. From January to June, the numbers have consistently grown over the year apart from a slight dip in March, reflecting a persistent upward trend.

From the below graph we see that IRD’s winding up applications is almost 2x the remainder of all creditors and has continued to grow month on month since March.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

Personal insolvency appointments remain at the low levels seen in the last few years and are looking very similar to 2022. As a breakdown of appointment types bankruptcies remain above their long term average with both No Asset Procedures and Debt Repayment Orders below their averages.

With the increasing levels of corporate insolvencies we can expect business related bankruptcies to increase in the later half of the year. This will likely be driven by the increased cost of living struggles, personal guarantees being called up by creditors, and overdrawn current accounts being a frequent asset in a lot of liquidations.

Election Year Insolvencies

The above graph details the total corporate and personal appointments across all appointment types in this year and the last two election years.

Total insolvencies have dipped below 2020 in May 2023 Personal insolvency appointment levels continue to drag down the total as you can see in the below graph they remain below 2017 and 2020 figures. The corporate insolvency figures sit between the last 2 election year comparatives.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..

Insolvency by the Numbers: NZ Insolvency Statistics April 2023

Economic recap

April saw the latest inflation figures released for the year to March 2023 showing a drop from the highs seen in the last two periods. The bulk of this drop in inflation however was from international factors while domestic figures remained elevated. Because of this and a number of other reasons the Reserve Bank has continued on their track whacking on a further 50 basis point rise to the OCR. We expect to see a final 25 basis points at the next meeting.

Comparatively Australia has seen their OCR drop, it is expected we will not see this for some time in NZ. The percentage of mortgage lending that remains at fixed rates is considerably higher in NZ, Australia on the other hand has a lot of its mortgage lending at variable rates, because of this a drop or raise in the OCR has a more immediate effect on the consumers purchasing power.

Of note over the last few months, we have seen a steady uptick in coverage of insolvency appointments by various media outlets, with particular focus on tiny home builders and the construction sector. From a numbers view point the constructions sector continues to dominate the total appointments ahead of other sectors as was the case throughout 2022. Commentators have been picking up on this fact with the common narrative becoming that we see more failures in this space before any sign of a recovery begins driven by squeezed margins and falling house prices. House sales continue to be at low volumes with prices maintaining a drop on the 3 month rolling average

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

Company insolvency appointments figures have finally come in for March 2023 with a number being late advertised after the end of the financial year, of note we passed the 2019 highs in both March and April (once late advertisers came through) of 2023 and were easily above 2020, 2021 and 2022 levels.

We did see the expected April drop as the result of appointments rushed into the end of the financial year March figures combined with a number of public holidays in the month of April.

As at the time of writing total corporate insolvency figures for the year to date were above the last 3 years but with the slower Jan and Feb 2023 we remain behind the 2019 total levels, thought not by a wide margin.

Solvent liquidations have returned to their standard levels as seen in Jan and Feb, as mentioned last month solvent liquidations typically see a spike in March as professional advisors and shareholders push the appointments through before the end of the financial year. While other liquidation appointments remain at consistent levels, we did see a lift in Voluntary Administrations for the month and Receiverships while higher than usual did fall from the levels seen in March 2023.

Winding Up Applications

Winding Up Applications for April increased on the prior years April figures and continued the upwards trend that has occurred since January 2023. Of note is the lift in IRD applications, typically for Aprils of past years commercial applications have taken the lead, not so from the latest figures. Whether this trend will continue for the remainder of the year is still to be seen given we are in an election year. It may be the case that the IRD is pushing through their appointments in the early part of the year before taking the pressure off as the election looms or they are finally dealing with the numerous derelict debtors they have on their books. Moving forward we are expecting continued growth into the peak months of June / July.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

Personal insolvency appointments remain at the lowered levels seen recently. It is likely that it will take some time for the corporate lift in appointments to flow through to personal insolvencies. This lift will likely come from increased interest rates, cost of living increases and guarantees on debts from failed companies.

Election Year Insolvencies

The above graph details the total corporate and personal appointments across all appointment types in this year and the last two election years.

While the corporate appointments are at elevated levels compared to 2017 & 2020 the very low personal insolvency appointment levels for the year to date mean that the total appointments remain below both 2017 and 2020. The corporate appointments will need to remain considerably above the past two election levels to make up for the personal insolvency figures, time will tell if that eventuates.

The difference between 2023 and the last two election years is noticeable in the state of the economy from low inflation and growing economies in the past to the present high inflation and shrinking economy with a cost-of-living crisis. It is still early days for the economic crisis to be completly reflected in insolvency figures which is typically a lagging indicator of the state of the economy.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..

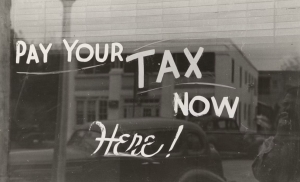

The risk of not paying your Taxes

The risk of not paying your company taxes to the Inland Revenue Department (IRD) in New Zealand can be significant and may include the following:

-

Penalties and interest: If you do not pay your taxes on time, you may be subject to penalties and interest charges. These charges can quickly add up and significantly increase the amount owed.

-

Legal action: The IRD has the power to take legal action to recover unpaid taxes. This can include issuing a statutory demand, taking court action, or placing a lien on your assets.

-

Business closure: If a business fails to pay its taxes, the IRD may take steps to wind up the business. This can result in the forced sale of assets and the closure of the business.

-

Personal liability: In some cases, company directors and officers may be held personally liable for unpaid company taxes (in particular unpaid PAYE which is Trust money). This can result in personal bankruptcy, legal action, and damage to personal credit ratings.

-

Reputational damage: Failing to pay taxes can damage a business's reputation and make it harder to secure financing, attract customers, or establish partnerships.

In short, not paying company taxes can have serious consequences for both the business and its owners. It's always advisable to ensure that taxes are paid on time and in full to avoid these risks.

If you are in arrears with company taxes to the Inland Revenue Department, there are several options available to you. These include:

-

Payment arrangement: You can negotiate a payment arrangement with the IRD to pay your tax debt over time. This can help you manage your cash flow while also meeting your tax obligations.

-

Late payment penalty remission: The IRD may consider remitting late payment penalties in certain circumstances. This may be available if you have a good compliance history and can demonstrate that the late payment was due to circumstances beyond your control.

-

Debt compromise: In some cases, you may be able to negotiate a debt compromise with the IRD. This involves settling your tax debt for less than the full amount owed. However, debt compromise is not available in all circumstances and is subject to strict criteria.

-

Voluntary disclosure: If you have made a mistake on your tax return or have failed to disclose information to the IRD, you can make a voluntary disclosure. This involves informing the IRD of the error or omission and paying any additional tax owed. Voluntary disclosure may help reduce penalties and interest charges.

-

Insolvency procedures: If you are unable to pay your tax debt and have exhausted other options, you may need to consider insolvency procedures such as liquidation, voluntary administration, or receivership. These options involve winding up the business or placing it under the control of an external party to manage the debt.

It's important to note that the options available to you may depend on your specific circumstances and the amount of tax debt owed. It's always advisable to seek professional advice from an accountant, tax advisor, or licensed insolvency practitioner before taking any action. Send us your enquiry from here.

Insolvency by the Numbers: NZ Insolvency Statistics March 2023

Economic recap

Figures released in March saw the New Zealand economy gross domestic product (GDP) fall 0.6% in the last three months of 2022, after a 1.7% rise in the September 2022 quarter. The drop at the close of the year was larger than predicted by many of New Zealand banks and a number of economists. Annually, GDP is up 2.4% year on year, unemployment remains low, at 3.3%.

Two large banks in the United States with significant exposure to the technology sector failed, while another entered liquidation under financial distress. These banks were Silvergate Bank, Silicon Valley Bank, and Signature Bank. Outside the United States, Credit Suisse joined the above 3 banks finding themselves in difficulty, the difference here being over the last few years Credit Suisse has been in and out of the news with a number of issues and negative media attention.

From a housing perspective the downward trend continues with both monthly sales figures and year to date sale figures at their lowest in 40 years dating back to figures last seen in the 1980’s.

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

March’s company insolvency figures were at the time of writing slightly above those of the past three years, as we move through April final March appointments will be advertised and widen the gap over the last three years, whether March can reach the 2019 levels will show in our April Newsletter. The breakdown in the types of appointments came back in line with normal monthly figures with shareholder appointments making up 80 of the 178 appointments, there was a significant bump in receivership with 27 for the month well above the monthly average of 7, this was largely due to a group of companies (20) being placed unto receivership at one time. Court appointments also remained high but not at their February levels bringing in 45 for the month.

Historically solvent appointments have seen a jump in March at the financial year end, this level while slightly elevated in March 2023 at 23 was below the past two years where solvent appointments were in the mid to high 30’s.

It will be of interest whether the normal drop seen in April follows past years, this is normally the result of appointments pushed through to get into the end of financial year and a number of public holidays in April resulting in less working days, this negatively affects appointments for the month.

Winding Up Applications

March 2023 applications while below 2021 figures are above 2022. Once again, the corporate winding up applications portion of total applications have remained above the IRD share of the applications. As outlined last month IRD often takes a few months to hit their stride in issuing winding up applications. As seen in the below graph from May/June onwards we should see an increase in IRD application, whether this plays out in an election year is yet to be seen.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

Personal insolvency stats remain low, if slightly above January’s figures. Of the 106 total, 50 were from bankruptcies, 49 from No Asset Procedures and the remainder from Debt Repayment Orders. This breakdown is roughly in line with past months, Bankruptcies and No Asset Procedures remain at similar numbers with Debt Repayment Orders 10% of the total.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..

When is a Director liable for trading insolvently?

Under New Zealand law, a director can be held liable for trading recklessly or insolvently if they allow the company to continue trading while it is insolvent or likely to become insolvent, and their actions cause a loss to the company's creditors.

The determinants for finding a director liable for trading recklessly or insolvently include:

-

Awareness of Insolvency: A director may be held liable if they continue to trade while the company is insolvent or if they become aware or should have been aware of the company's insolvency and failed to take appropriate action to address it.

-

Breach of Directors' Duties: Directors have a duty to act in the best interests of the company, exercise due care and diligence, and avoid reckless or imprudent decisions. If a director breaches these duties and causes losses to creditors, they may be held personally liable.

-

Cash Flow and Financial Projections: Directors have a responsibility to monitor the company's cash flow and financial projections regularly. If they ignore warnings of impending insolvency or rely on unrealistic projections, they may be held liable for reckleAss or insolvent trading.

-

Transactions at Undervalue: Directors who engage in transactions that benefit themselves or related parties at the expense of creditors may be held liable for trading recklessly or insolvently.

-

Failure to Seek Professional Advice: If a director fails to seek professional advice or act on advice received from accountants, lawyers, or other experts regarding the company's financial situation, they may be held liable for trading recklessly or insolvently

In summary, a director can be held liable for trading recklessly or insolvently if they fail to take appropriate action when the company is insolvent or likely to become insolvent, breach their duties as a director, fail to monitor the company's financial position, engage in transactions that benefit themselves or related parties at the expense of creditors, or fail to seek professional advice.

Insolvency by the Numbers: NZ Insolvency Statistics February 2023

Economic recap

February saw another lift in the Official Cash Rate by 50 basis points, with a further 75 basis points expected to be added this year. The language from the reserve bank indicated that they had not seen the expected signs in inflation pull back and were continuing on their chosen path from 2022 to get inflation under control as quickly as possible.

The extreme weather events experienced in January continued into February with considerable damage to parts of the North Island. While the immediate effects have been considerable in certain areas the long term effects and costs will have wide reaching repercussions as additional spend will be necessary and likely increase demand on limited supplies and pressure on inflation figures.

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

February's company insolvency figures are slightly above those of the past two years. The breakdown in the types of appointment is where the real difference can be seen with court liquidation making up 47 of the 134 total appointments. This is above the 2021 and 2022 levels, more in line with 2020’s February court liquidation numbers before Covid and lockdowns became an issue.

Receiverships saw an increase with 8 for the month returning to levels not seen since 2020. What we can take from this along with the court appointments is that while there remain shareholder appointments there has been an increase in creditors (including IRD) taking action against derelict debtors either through winding up applications or secured creditors appointing receivers under their financing documents they hold against company assets.

Winding Up Applications

February has shown growth on the elevated levels displayed in January 2023. The corporate winding up applications portion of total applications have remained above the IRD share of the applications for the second consecutive month. Traditionally IRD may take a few months to warm up following the Christmas break with their winding up applications as staff return to the office. It is normally from March onwards that IRD applications track up to exceed the corporate applications. Of interest the 64 winding up applications seen in February 2023 have exceeded 2/3rds of the monthly totals in 2022 and 5/6th of the 2021 monthly applications.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

For another month personal insolvency stats continue their downward track to under 50 total in January 2023. While corporate insolvencies continue to move upwards this is not yet reflected in the personal insolvency stats. Over time the corporate stats increasing will likely flow through to personal insolvencies as personal guarantees get called up and collections actions continue. This has not happened yet but may increase as 2023 progresses.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..

How do I get out of a struggling business?

If you're running a struggling business, you may feel overwhelmed and unsure of what steps to take next. It's a tough situation, but it's not uncommon, and there are options available to help you get out of it.

The first step is to assess the situation and identify the root causes of your business's struggles. This may involve reviewing your financial statements, identifying your cash flow issues, and analyzing your operations to pinpoint areas of inefficiency or waste. Once you have a clear understanding of the problems, you can begin to develop a plan to address them.

One option for getting out of a struggling business is to consider restructuring. This may involve renegotiating your debts with creditors, selling assets, or downsizing your operations. A restructuring plan can help you get back on track by reducing costs and improving cash flow.

Another option is to consider a business sale. If you're unable to turn your business around on your own, selling your business to a buyer who has the resources and expertise to take it to the next level may be a good option. This can also help you avoid the stress and financial burden of continuing to operate a business that is struggling.

If restructuring or selling your business are not viable options, you may consider a formal insolvency process. This may involve liquidation or voluntary administration. A liquidation involves winding up the affairs of the business and selling its assets to pay off creditors. A voluntary administration involves appointing an administrator to manage the affairs of the business while a plan is developed to address the financial difficulties.

At McDonald Vague, we understand the challenges that come with running a struggling business. Our team of insolvency practitioners can help you navigate the process and develop a plan to get out of the situation. We can provide guidance on restructuring options, assist with the sale of your business, and provide support throughout the insolvency process.

Don't let a struggling business drag you down. Contact us today to discuss your options and find a way forward. With the right plan in place, you can get out of a struggling business and move on to better opportunities.

Is Liquidation the best option for your business?

If your business is struggling with debt and financial difficulties, you may be considering liquidation as a way to address your problems. However, liquidation is not always the best option for every business. Before making any decisions, it's important to consider all the available options and seek professional advice from experienced insolvency practitioners like McDonald Vague.

Liquidation is a process by which a company's assets are sold to pay off debts to creditors, and the company is then dissolved. While it may seem like a quick solution to financial problems, it can have serious consequences for the company's directors, shareholders, and employees. It's important to understand the potential implications of liquidation before deciding whether it's the best option for your business.

One alternative to liquidation is a voluntary administration, which is a process that allows a company to restructure its debts and operations while continuing to trade. Voluntary administration may be a better option for a business that is experiencing temporary financial difficulties and has the potential to return to profitability with the right management and support.

Another option is a formal or informal compromise, which involves negotiating with creditors to reach a settlement on the company's debts. This can be a less expensive and less disruptive option than liquidation, and can help preserve the company's reputation and relationships with its customers and suppliers.

Ultimately, the best option for your business will depend on a variety of factors, including the nature and amount of your debts, the company's assets and liabilities, and the potential for future profitability. It's important to seek professional advice from an experienced insolvency practitioner who can help you evaluate your options and make an informed decision.

At McDonald Vague, we have the expertise and experience to help you determine the best course of action for your business. We can provide you with a clear and objective assessment of your situation, and help you explore all the available options. We can also assist you with voluntary administration, formal or informal compromises, or other alternatives to liquidation, if appropriate.

Don't wait until it's too late to seek help for your struggling business. Contact us today to discuss your options and get the expert advice you need to make the right decisions for your business.

Insolvency by the Numbers: NZ Insolvency Statistics 2022 Year End Wrap Up and January 2023

Economic recap

Inflation has remained constant in the final quarter of 2022 at 7.2 the same as at the end of the third quarter in 2022, it is still down from the 7.3 high point seen during 2022. While economists and the Reserve Bank were hoping for a drop this factor will be weighing on the Reserve Banks mind in its ongoing fight against getting inflation back to its 1%- 3% target band. While other developed countries across the world begin to see inflation coming under control we are not yet there in New Zealand.

Coupled with the elevated inflation we have business confidence at all-time lows as seen in surveys run at the end of 2022 and through January 2023, signalling that businesses do not have high hopes for the coming year, and we are likely to see businesses struggle throughout 2023. We have seen unemployment figures rise 0.2% with the latest quarters data being released, however staffing pressures in certain industries remain. Coupled with the extended fuel levy relief through till June 23 that will likely continue to provide some relief to the cost of living crisis.

The next Official Cash Rate review is on 22 Feb 2023 where we will likely see a rise of up to 75 basis points with a number of commentators now predicting a 50 basis point rise. With up to 50% of mortgage holders coming off lower fixed rates in the next 6 months the affect of these OCR lifts continue to be felt by consumers as interest rates double and in some cases triple.

While January is normally a slow news month the change of PM has given the media something to report on along with its increase in personal and corporate insolvency reporting that has also seen an uplift over the Christmas break, particularly if the business operated in the construction sector. In an election year these failing businesses and cost of living crises will likely play a part in election promises by the various parties and how they will mitigate the fallout to the wider economy.

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

December’s figures while not as high as November, were typical for the month with less work days in the month due to the Christmas break, the levels seen however were above both the 2020 and 2021 December figures. January on the other hand has started the month with appointments in line with earlier years with no court appointments for the month and professional advisors on leave appointment figures remain low. How the recent floods across the north island remains to be seen with businesses losing substantial stock to water damage and some areas (Coromandel) blocked off to visitors due to slips tourism will likely be affected.

From a yearly point of view total appointment figures for 2022 exceeded the 2020 and 2021 appointments. While there was a slight increase in voluntary administrations in 2022 and a reduction in receiverships the bulk of the new appointments came through shareholder insolvent appointments. Court appointments for the year remained in line with prior year ratios.

Winding Up Applications

December winding up figures saw the traditional seasonal drop. January however exceeded the prior 2 years winding up applications.

December’s corporate applications have remained similar to prior year’s figures, it is the IRD applications that have picked up and continued to rise in January. While IRD has a backlog of derelict debtors how far their recovery collections will continues into 2023 as an election year is yet to be seen.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

Corporate appointments continue to follow prior years patterns with a slight lift, this has not been reflected in personal insolvency appointments. The numbers track down in the December month, lower than all prior Decembers with no lift in sight. The graph below shows the downwards slope over time and the continued reduction in bankruptcy figures and the increased portion No Asset Procedures have continued to make up of total personal appointments.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..